Personal finance is one of the most important aspects of personal life. It’s a valuable skill to learn throughout your life, and even more so as you get older. Here are some personal financial planning tips that can help you establish a budget and avoid debt.

What is personal finance?

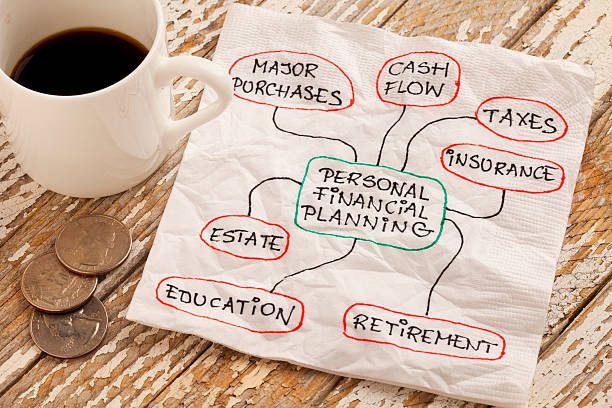

Personal finance is the financial planning that an individual makes for their future. It includes saving, budgeting or spending, and investment choices. Personal finance is a broad term for anything related to money management. It can be taken in a wide variety of meanings, but in general it refers to the ways individuals manage their assets and income. Personal financial planning is a way to develop a systematic approach to managing your money, including your investments, debts, tax planning, retirement planning, and more.

How to set up a budget

Budgeting is a system for tracking your income and expenditures. The goal is to control your money so that you can save it and invest it to achieve financial independence. In order to create a budget, you must first understand the difference between your income and expenses, because without this knowledge it would be hard to accurately predict what you will spend in a given month or year. Calculate how much money you’ll need for bills every month, food, clothing, savings goals, etc. After that, create a sheet of paper with columns that map out all your anticipated expenses.

Basic financial planning

Personal finance planning is a challenging and multifaceted topic. It can be difficult to know where to start when it comes to finding the best methods for your situation. Many people find that personal financial planning is something they need to tackle alone. With that said, we recommend these basic tips:

-Start simple

-Build on what you are already doing

-Make an investment

Types of investment accounts and what they each offer

Many financial advisors will recommend a variety of investments. Some will go for a full-service brokerage firm, some may want to keep things simple with a self-directed IRA or 401k, and still others will cover all their bases with a general portfolio. It’s up to you which investment account is right for your needs.

The role of insurance in personal finance

Insurance is a key component of personal finance, there to help you when something happens. Learning what kind of insurance plan you need and how much it should cost before spending money on an agent can help you save time, money, and stress.

The importance of saving for the future

Saving money and planning for your future is a very important thing to do. If you want to be prepared for anything that might happen in the future, you should start saving now. Being proactive is the best way to ensure that you can save as much as possible for your retirement or any other financial goals you have.

Conclusion

Personal Financial Planning Tips can help you manage your money better. It is important to put your best foot forward when it comes to personal finances.